In an era where digital commerce is rapidly expanding, ensuring secured transactions has become paramount for both businesses and consumers. Understanding the importance of secured transactions and implementing best practices can safeguard against potential threats, ensuring trust and confidence in online payment systems. Do you need a secure online bank account? If yes then you need to continue your reading.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Support

- Secure Transactions

- Quick Integration

Get started

Contact sales

What is a Secured Transaction?

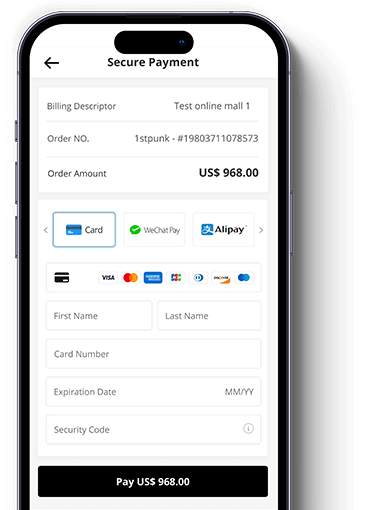

Secure transactions refer to financial exchanges conducted in a safe and protected manner to prevent unauthorized access or fraudulent activities. Similarly, MC Free Bank Accounts uses encryption to protect your personal and financial data during transactions. Additionally, MC Free Bank Accounts often incorporate features like biometric authentication or PIN codes to add an extra layer of security.

What are Securities Financing Transactions?

Securities financing transactions (SFTs) are specialized forms of secured transactions involving the temporary exchange of securities for cash or other securities. Examples include repurchase agreements (repos), securities lending, and margin lending. In these transactions, the borrower provides securities as collateral to the lender, with the agreement to repurchase them later, often at a slightly higher price. SFTs play a crucial role in financial markets, providing liquidity and facilitating the efficient functioning of trading activities.

What is Secure Data Transaction?

Secure data transactions involve the safe exchange of information between parties in a manner that protects the data from unauthorized access, alteration, or theft. In the context of online payments, secure data transactions are essential to prevent cyber criminals from intercepting sensitive information such as credit card numbers, bank account details, and personal identification information.

Recommended article:The Best Free Virtual Credit Card Options for Secure Online Transactions

Best Practices for Ensuring Secured Transactions

To ensure the security of online payments and protect against potential threats, businesses and consumers should adhere to the following best practices

· Use Strong Encryption

Encryption is a fundamental tool for securing online transactions. By converting sensitive information into a code that can only be deciphered with the correct key, encryption ensures that even if data is intercepted, it cannot be read by unauthorized parties.

· Implement Multi-Factor Authentication (MFA)

Multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of verification before accessing an account or completing a transaction.

· Regularly Update Software and Systems

Cybercriminals often succeed in hacking outdated software and systems. Regularly updating software, including payment gateways and e-commerce platforms, ensures that security patches and enhancements are applied, reducing the risk of exploitation.

· Conduct Security Audits and Penetration Testing

Regular security audits and penetration testing help identify and address potential vulnerabilities in a system. By simulating attacks, businesses can discover weak points and take proactive measures to fortify their defenses.

· Educate Employees and Customers

Educating employees and customers about the importance of security practices, such as recognizing phishing attempts, using strong passwords, and safeguarding personal information, can reduce the likelihood of successful attacks

What Do You Need To Know About MoneyCollect Free Bank Accounts?

An MC Free Bank Accounts, like a mobile wallet, is a digital application that allows you to store payment information on your smartphone. It enables you to make various financial transactions, such as payments for purchases, transfers, and even managing loyalty cards, all from your mobile device. Some benefits of using an MC Free Bank Account include convenience enhanced security features like encryption and biometric authentication, and the ability to track your transactions easily. Additionally, MC Free Bank Accounts often offer rewards and cashback incentives, making them a popular choice for many users.

Its features include the following.

· Easy Payments

· Request Money

· Group Payments

· Secure

· Multi-Payment Methods

· Real-time Notifications

· Transaction History

· Customer Support

How to Become a Member Of MC Free Bank Accounts?

By following these steps, users can effectively use their MC Free Bank Accounts for various financial transactions and enjoy the benefits it offers.

1. Download the MC Free Bank Accounts app from the respective app store on your smartphone.

2. Install the app and create an account by following the on-screen instructions.

3. Add your payment information, such as credit or debit cards, to the wallet securely.

4. Explore the features of the app, like making payments, transferring money, and managing loyalty cards.

5. Familiarize yourself with the security features of the MC Free Bank Accounts, such as setting up PIN codes or biometric authentication.

6. Enjoy the convenience of making payments with just your phone and take advantage of any rewards or cashback offers available.

Ending Remarks

Ensuring secured transactions is a critical component of maintaining trust and confidence in online payment systems. By understanding the nature of secured transactions, implementing best practices, and leveraging emerging technologies, businesses and consumers can protect themselves against potential threats. The continuous evolution of security measures is essential in the fight against cybercrime, ensuring that digital commerce remains a safe and viable option for everyone. What are you waiting for? Go and make an online bank account to enjoy the endless benefits and rewards.